Interfacing with your system of Financial Accounting

ServiceDesk is not meant to replace your current financial accounting system for tasks like writing checks, recording expenses, calculating depreciation, and creating financial statements. It's mostly not for financial accounting. But it does collect some financial data you'll need. Mainly, it gathers revenue-based information related to income, such as sales, accounts receivable, collected funds, sales tax liabilities, and inventory. You'll need to input this data into your financial accounting system, probably once a month or maybe just yearly, based on your company's preference.

Basic concepts

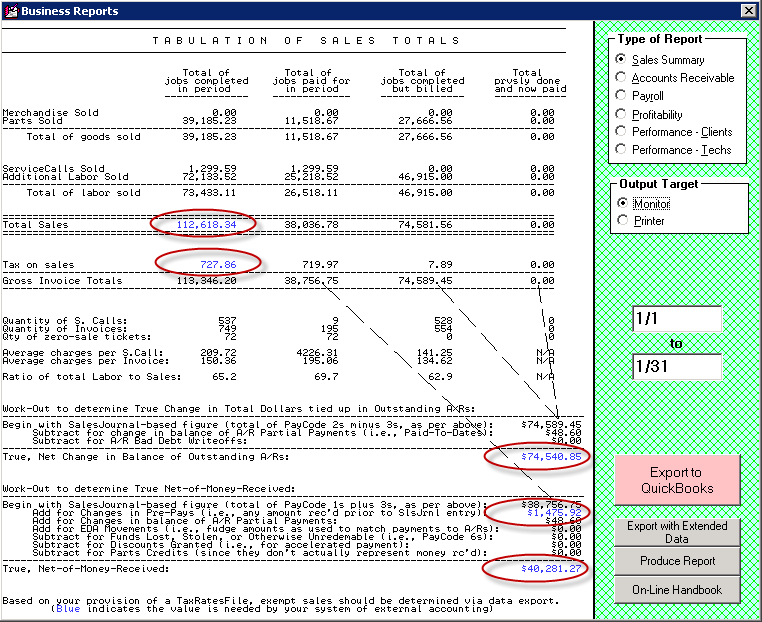

Except for one thing, the ServiceDesk Sales Report gathers and organizes all the information you need to transfer into your financial accounting system. It even highlights the specific numbers you need to move in blue:

This report has a few important numbers related to your revenue. It doesn't include the cost-side element (specifically the cost of goods sold). You can give this report to an accountant who will know how to use it.

You should run this report at the end of each accounting period. It summarizes what happened during that period, which you can use in your full accounting system.

You must put this information into your full accounting system if you don't have an accountant. If you use QuickBooks, you can use the “Export to QuickBooks” button (see the picture and look for the hot-pink button at the bottom right). This button puts the information into the system for you. If you use a different system, you must do it yourself. It's not much work because there are only a few numbers.

We also need to talk about the cost of goods sold. We'll go into more detail about this and everything else in the next sections.

Integration with QuickBooks

We’re starting with this because most ServiceDesk users and small businesses in North America use QuickBooks.

Apart from one element related to the cost of goods, integrating with QuickBooks is very straightforward.

Entering the standard “Revenue-Side” Data into QuickBooks

Just run the Sales Report at the end of each accounting period and click the Export to QuickBooks button. Then, in QuickBooks, click on File, then Import, and select the file you exported from ServiceDesk.

This will make QuickBooks create internal accounts that match the blue-highlighted values on the ServiceDesk Sales Report. It also makes journal entries in these accounts.

For instance, QuickBooks will create an account called "SD-Tallied Sales." When you run an Income-Statement report in QuickBooks (for a period that includes an export/import), the report will show the "SD-Tallied Sales" amount as a Sales-Income item.

That's basically all you need to do to connect ServiceDesk to QuickBooks. It's really that simple.

Entering bank deposits into QuickBooks

When you deposit money into your bank account that was collected through ServiceDesk, you'll need to record it in QuickBooks. Even if you use ServiceDesk to prepare your deposit, you still need to do this.

When you register a deposit in QuickBooks, it will ask for the source of the money. If the money was collected through ServiceDesk, you should select “ServiceDesk-Tallied Funds Received” as the source. This is an account created automatically by the ServiceDesk-to-QuickBooks process.

You might notice something unusual when doing this. You will likely deposit money regularly throughout an accounting period, but ServiceDesk won't tell QuickBooks about the money it's received until the end of that period.

For example, let's say you collect $40,000 in a month. You deposit $10,000 into your bank account every Friday of that month. Each time, you record the source as “ServiceDesk-Tallied Funds Received.” But it's not until the end of the month that the $40,000 total is recorded in that account.

This means that your deposits might make that account appear negative during the accounting period. But don't worry - it will balance out to zero at the end of the period when ServiceDesk transfers the information to QuickBooks. This is a normal part of the process.

Entering Cost-of-Goods-Sold, into QuickBooks

The cost of parts used and items sold is the only part of your financial data not based on revenue. It must be managed outside the SalesSummary and can't be included when you move data to QuickBooks.

ServiceDesk doesn't directly manage the cost of goods sold. QuickBooks (or any other system you use) handles the actual payment for these costs as you write checks to your suppliers. But just because you're paying for a part through QuickBooks doesn't mean you're also registering for a cost-of-goods sold simultaneously. Usually, a payment changes cash in your bank into an added value in your inventory account.

Even though the money is spent through QuickBooks, QuickBooks doesn't directly have what it needs to calculate cost-of-goods-sold. For accurate calculations, QuickBooks needs information from ServiceDesk. There are several methods you can use for this.

The “traditional accounting” method calculates the cost of goods sold by taking the starting inventory value, adding any purchases, and subtracting the inventory value at the end. ServiceDesk can quickly give you an inventory value snapshot at any time using the shortcut F10 > I > T. If you like this method, you'll need to figure out how to use it in QuickBooks. But remember, this method can cause timing issues. You might pay for items in a different period from when you received them. If you're trying to track monthly income, this can cause problems unless you take steps to fix it. For example, you could record each purchase in QuickBooks when it happens instead of waiting to record it when you write a check the next month. This issue can cause your income to look higher or lower in a given month, but it evens over time.

Likely the best method is to use the report in ServiceDesk that’s obtained via the shortcut path Ctrl + F8 > W. A good title for this export would be “Report on Goods Sold.” You can run this report for the accounting period in question (whether it’s for a particular month, a year, or whatever is the case) and get a tally of the exact items you actually used and, therefore, truly bore expense upon (open the export in Excel and do a Sum function on column H to get this figure). You can then manually enter this figure into QB. This method somewhat reverses from the traditional method. So far as work in QB is concerned, you’ll take your purchases, and add all to inventory. You’ll then obtain your cost-of-goods-sold direct from SD and subtract that from inventory.

You can simply count each payment to parts vendors as direct cost-of-goods sold (and any creditbacks as reductions). While this method may not fully align with standard accounting principles and may cause some differences in monthly profits, these differences balance out over time. This method is very easy to implement. It's a good option if you're not too concerned about tracking exact profits each month.

For clarity of your understanding, the default method that QB would naturally be inclined to push you toward (in particular, if you were allowing it to manage each of your sales transactions at the per-invoice level) would be to register cost-of-goods sold in conjunction with each and every involved sale (i.e., I am entering X sale, and my cost of the materials involved in it was Y). So that you know, there is no accommodation for this method in any reasonable ServiceDesk-QuickBooks partnership.

SD-Tallied accounts for QuickBook-Online import

TIP! To review these accounts independently, export a copy of the QuickBooks.IIF file from ServiceDesk's SaleSummary report. Make a copy of the file. Right-click the copy of the file in File Explorer and open the file in Microsoft Notepad.

Account Number | Account Name | Type | DetailType

SD-Tallied NetOfFundsReceived | Other Current Assets | Other Current Assets

SD-Tallied PartsCreditsReceived | Other Current Assets | Other Current Assets

SD-Tallied AccountsReceivable | Other Current Assets | Other Current Assets

SD-Tallied SalesTaxPayable | Other Current Liabilities | Other Current Liabilities

SD-Tallied CustomerDeposits | Other Current Liabilities | Other Current Liabilities

SD-Tallied SalesIncome | Income | Service/Fee Income

SD-Tallied BadDebtExpense | Expenses | Bad Debts

SD-Tallied BadFundsExpense | Expenses | Bad Debts

SD-Tallied EDAs | Expenses | Bad Debts

SD-Tallied DiscountsGranted | Expenses

SD-Tallied Accounting Faults | Expenses

Integration with any other accounting system

The main principles are still the same if you're using an accounting system that's not QuickBooks. However, you won't have an automatic transfer of information from ServiceDesk to your system. You'll have to manually input data, but it's not too much work. You only have to do it at the end of each accounting period. Plus, all the important numbers are highlighted in the ServiceDesk Sales Report.

The tricky part might be figuring out how to enter the numbers into your system if you're not an accountant. This section is here to help you understand that.

We can't give exact instructions because we don't know what system you're using. But we can help you understand the basics of accounting.

Every accounting system has a "Journal" or "General Ledger". This is where you record everything that changes your financial situation. You'll be using this to input the summary information from ServiceDesk.

All modern accounting systems use "double-entry bookkeeping." This doesn't mean entering information twice. It means that every financial event affects at least two different areas. For example, when you make a sale, you increase your sales, cash, or accounts receivable. Every financial event has this dual effect. The double-entry system makes sure everything balances.

Depending on your system, you might need to make an entry in the general ledger where this double-entry is obvious. Or, your system might hide the double-entry aspect a bit. Either way, understanding this will help you input the information correctly.

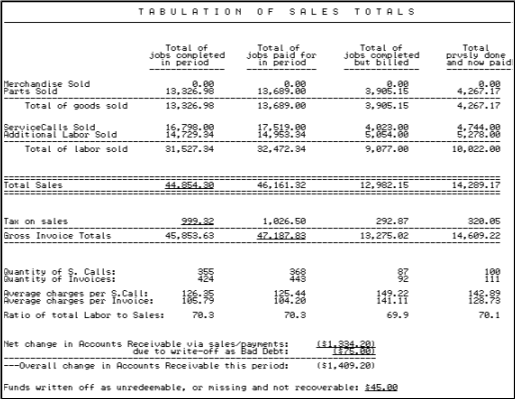

Suppose you have a Sales Report with certain figures for a given accounting period. The ones that need to be moved to your financial accounting system are underlined.

Again, though your system may have an interface that presents you with a different path for the purpose, the following are entries that will ultimately be going into its general ledger:

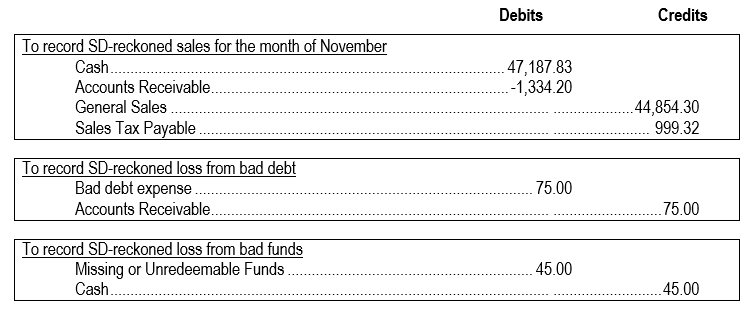

If you're not an accountant, don't worry if some of these concepts seem confusing. For instance, it might seem strange that an increase in cash is noted as a "debit" instead of a "credit." But that's just how it's done. "Debit" and "credit" are just labels for different columns.

Here's what it all means:

In the first example, we're noting that we have $47,187.83 more in Cash and that our Accounts Receivable has decreased by $1,134.20. We're also adding $44,854.30 to our Sales account and $999.32 to our Sales Tax Payable account. All of these entries reflect our sales for the month.

The ServiceDesk Sales Report also tracks other actions, not just sales. It helps manage your accounts receivable and collected funds. Sometimes, you won't be able to collect some of your Accounts Receivable, so you'll have to write it off as bad debt. ServiceDesk can do this, but you must record it in your financial system. Similarly, sometimes you might collect funds that later turn up missing or can't be collected (like bounced checks). ServiceDesk can record these losses, but you must add them to your financial system.

The second and third examples show these kinds of entries. The first records a $75.00 Bad Debt Expense and a decrease in Accounts Receivable. The second one records a loss of $45.00 in Missing or Unreedemable Funds and a decrease in our Cash account.

No matter what system you use, these are the kinds of entries you'll need to make. Even if your system hides the general journal, it still needs this information.

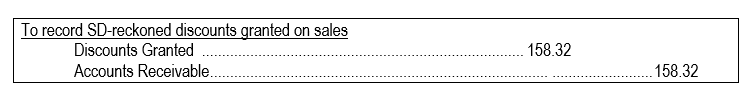

Depending on the situation, you might need to make other entries. For instance, if you give some clients discounts for paying quickly, the ServiceDesk Sales Report will show that. If you gave out $158.32 in discounts, you'd need to record that in your financial system. A suitable resulting entry to your system of financial accounting would look something like this:

The same principles apply here, as with the other entries. We're simply stating that we've given a discount of $158.32, reducing our cash by the same amount.

This isn't difficult to understand. The main goal is to transfer the financial data recorded and summarized by ServiceDesk into the financial accounting system you use for everything else. Even if some financial accounting principles seem strange, they are just a few numbers, and the basic concepts are simple.

There's also the task of accounting for the cost of goods sold. This isn't included in the ServiceDesk Sales Report and must be handled separately. How you handle this is the same as if you were using QuickBooks. The only relevant difference is that you might want to know how an entry reflecting cost-of-goods-sold would look in the general ledger.

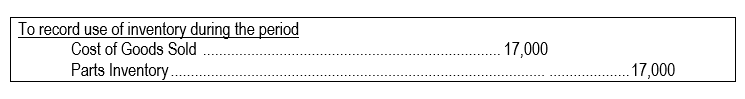

Let's say you've calculated that the cost of goods sold during the accounting period is $17,000. In this case, your general ledger entry would need to look something like this:

Don't worry, it's pretty straightforward.

If you're feeling overwhelmed, keep in mind that accountants study for four years, and the information you need from ServiceDesk is minimal and easy to understand.

If you still find the accounting part challenging, consider hiring an accountant. They can read this section, understand what ServiceDesk needs to do, and guide you through the process in your own accounting system. Once you understand the process, you'll find it quite straightforward to make the required entries periodically.