Managing Parts-Credit accounting in connection with ServiceDesk

Though something of an accounting nuisance, parts credits are not a nightmare. We must understand what we’re dealing with.

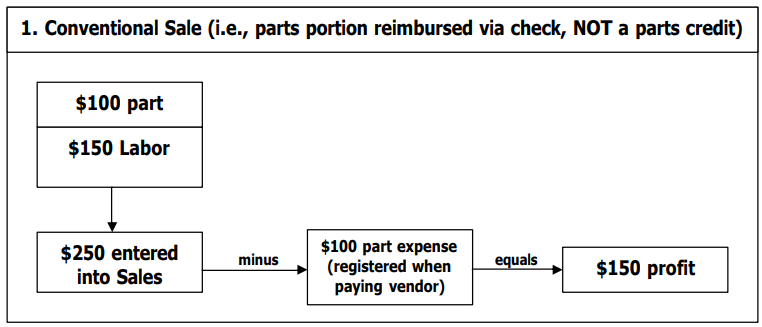

Let's compare two different payment scenarios in a service job:

Normal payment scenario

You charge $150 for labor and $100 for a part

The manufacturer pays you $250 in total

You pay your vendor $100 for the part

This is a straightforward process where you receive full payment and then pay for the part separately.

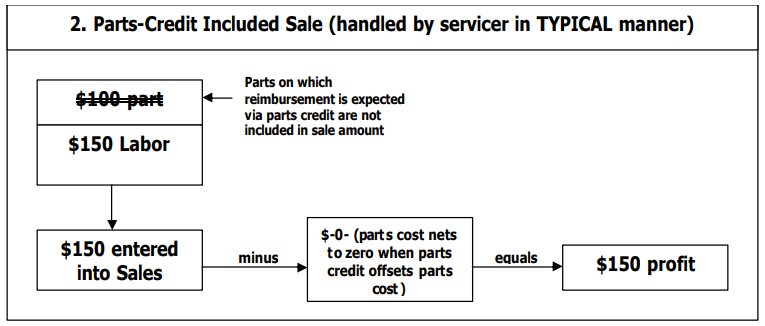

Common warranty scenario

In this case, your cost for the part becomes zero because your parts vendor gives you a credit.

Here's how service companies usually handle this.

The process described above is simple, but there's one issue we need to address. In ServiceDesk, we use Accounts Receivable to track all payments for a job, including parts credits. To do this properly, we must include all parts in our SalesJournal entries, even those for which we expect to get credits later.

This means we should record transactions in the first illustration (normal payment scenario), not the second illustration (common warranty scenario). Doing this ensures that ServiceDesk can accurately track all aspects of each job, including parts credits.

Unfortunately, the world isn't perfect. While this approach makes everything run smoothly in ServiceDesk, it challenges your final accounting. In our example, ServiceDesk will report $250 in sales (as shown in the normal payment scenario). Still, you'll record $0 in parts expense (after writing checks to your vendor), as per the common warranty scenario. This would result in an artificially inflated profit of $250 without a correction.

ServiceDesk addresses this issue in its QuickBooks export by including an entry for Parts Credits Received. The correction is then left to you—within QuickBooks, you'll need to apply this amount according to your preference.

Specifically, we recommend one of two approaches:

Make a journal entry that increases your parts cost by the Parts Credits Received amount

This entry will be a credit to the Parts Credits Received account and a debit to your Parts Expense account.

We’re using “Parts Expense” in a thoroughly generic sense. In practice, it’s more likely that in QuickBooks you’ll find the terminology, as used for this account, is “Cost of Goods Sold.”

Effectively, it will result in the same result in the normal payment scenario.

Make a journal entry that reduces your sales by the Parts Credit Received amount

This entry will be a credit to the Parts Credits Received account and a debit to the Sales Income account.

Please do not try to understand how the terms “debit” and “credit” are used in accounting. The usages have little relation to what you’d typically think.

Effectively, it will result in the same result in the common warranty scenario.

Just so you know, we could have programmed the QuickBooks export to do either scenario 1 or 2 for you automatically. Instead, we thought it best to let you handle it as you prefer. Plus, by exporting the Parts Credits Received amount to QuickBooks as exactly that, we allow you to see—from within QuickBooks—exactly what’s involved.