Part credit accounting

How Parts-Credit Accounting is Managed By (and in Connection With) ServiceDesk

Though something of an accounting nuisance, parts credits are not a nightmare. We simply must understand what we’re dealing with.

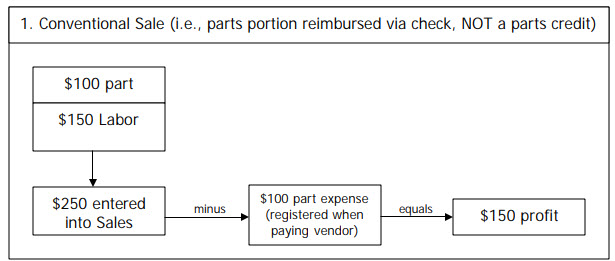

First (and by way of contrast from a parts-credit situation), let’s look at a normal pay scenario where your sale includes $150 in labor and $100 (at cost) for a part. You’re going to be paid for both via direct check in the amount of $250 from the manufacturer. You’re going to pay your vendor via your own direct check in the amount of $100. Thus:

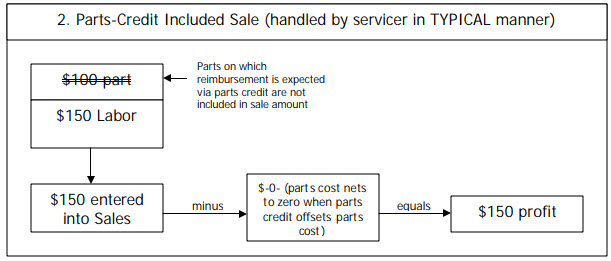

Now, let’s contrast with a more typical warranty scenario, where your cost on the part is netted to zero, via a parts credit as issued by your parts vendor. In particular, let’s paint it the way it’s typically accounted for by servicers:

The above is straightforward except for one problem. In ServiceDesk, we want to use the Accounts Receivable functions as a mechanism to assure we receive all types of “payments” associated with performing a job, including parts credits. But, to create the A/R records via which this can happen, we must include, in our SalesJournal entries, even the parts on which parts credits are expected (i.e., as per the illustration on Page 1, and NOT per the illustration immediately above).

Sadly, the world is not perfect. While the above expedient makes everything purr lovingly in ServiceDesk, it creates a problem for your end-game accounting. For our pretend fact situation, ServiceDesk will report $250 in sales (as per Illustration 1), but you’ll register $0 in parts expense (i.e., after writing checks to your vendor), as per Illustration 2. Absent some correction, this would result in showing a profit that’s falsely too high, at $250.

The needed correction is provided by the fact that, in its QuickBooks export, ServiceDesk includes an entry for Parts Credits Received. It’s up to you, within QuickBooks, to then apply the amount in that entry as per preference.

Specifically, we recommend one of two approaches:

Make a journal entry that reduces your sales by the Parts Credits Received amount. This entry will be a credit to the Parts Credits Received account, and a debit to the Sales Income account. Effectively, it will make you end up with the same result as shown in Illustration 2.

Make a journal entry that increases your parts cost by the Parts Credits Received amount. This entry will be a credit to the Parts Credits Received account, and a debit to your Parts Expense2 account. Effectively, it will make you end up with the same result as shown in Illustration 1.

FYI, we could have programmed the QuickBooks export to automatically do either 1 or 2 for you. Instead, we thought it best to let you handle as per your own preference. Plus, by exporting the Parts Credits Received amount to QuickBooks as exactly that, we let you see—from within QuickBooks—exactly what’s involved.